Brief information Kanak Capital Markets

Promoting the idea of effortless earnings, Kanak Capital Markets describes itself as an international online platform for trading financial instruments, including stocks and stock indices. It claims to provide services to clients from various countries, except for US residents, subject to local legal requirements.

However, despite claims of operating since 2012, the website does not contain any registration documents confirming the date of establishment and legal status of the broker. Copies of licenses from recognized financial regulators are also not provided. The only official information provided is the data posted on the website: the name Kanak Capital Markets LLC with the MISA regulation, Comoros Union, but without providing supporting documents or links to the registry.

Despite the fact that, as stated on the website, the company is registered in the Comoros Islands, its office is located at 4 Lermontov Street, Office Suite 12, Batumi 6004, Georgia. In addition, several email addresses and a telephone number: +44 800 066 8222 are provided for contacting support. There is also a feedback form for support.

Kanak Capital Markets trading terms

The company offers two trading platforms:

Kanak Capital Markets Platform — the broker's proprietary web-platform designed for opening and maintaining real trading accounts.

MetaTrader 5 — a popular terminal used for demo accounts that allows users to test trading without risk.

Users are offered the opportunity to trade the following assets:

equities,

market indices,

raw materials,

noble metals.

Thus, clients are offered a choice between the company's internal platform for real trading and MetaTrader 5 for demo mode, with access to basic financial markets.

Trading accounts at Kanak Capital Markets

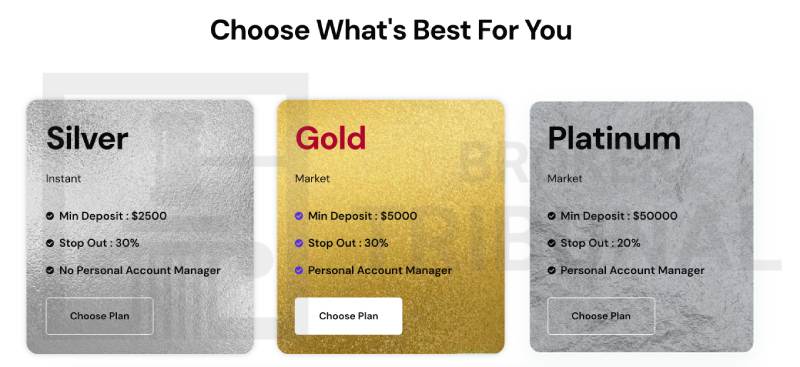

The company offers a demo account on the MT5 and real money trading on its proprietary trading terminal. It is stated that the company has several real money accounts:

Silver — $ 2500; Stop Out 30%; Personal Account Manager.

Gold — $ 5000; Stop Out 30%; Personal Account Manager.

Platinum — $ 50000; Stop Out 20%; Personal Account Manager.

At the same time, the main trading parameters are not disclosed. The website does not provide information about leverage, swaps and spreads, or trading commissions. To obtain detailed information about each account type and trading conditions, users must register.

Registration and personal account on kanakmarkets.com

To register on the website, users must provide their name and date of birth, contact details, and complete verification and KYC procedures. After that, they can start trading by signing in to their personal account with their username and password.

Deposits and withdrawals with Kanak Capital Markets

The main methods of depositing funds are:

bank transfer,

payment cards.

Bank transfers are accepted in US dollars, UAE dirhams, euros, pounds sterling, and Swiss francs. The company does not charge a commission, but the customer's bank may retain its own fees.

Withdrawal requests are made on the website by filling out a form. The following withdrawal methods are available

Back-office Department;

bank transfer;

payment cards.

Detailed information about commissions, limits, and processing times is not publicly available.

Conclusion about Kanak Capital Markets

Despite statements about registration and licensing, as well as a copy of a letter of appreciation, there is no actual evidence of this on the website. Trading conditions are not disclosed. Before working on the platform, you should study reviews of Kanak Capital Markets on third-party resources.