Brief information Landmark Markets

Global offshore broker Landmark Markets positions itself as a leading CFD trading platform providing access to volatile financial markets. The company announced its founding in 2009.

According to its official website landmarkmarkets.com its head office is located at Euro House, Richmond Hill Road, Kingstown, Saint Vincent and the Grenadines (registration number 3491LLC2024). Another subsidiary is registered at Ground Floor, Rodney Court Building, Rodney Bay, Gros-Islet, Saint Lucia (legal entity ID 2025-00682). Copies of the incorporation certificates have not been published.

The LandmarkMarkets broker does not mention any licenses from local financial regulators or provide information about its staff.

You can contact the company by phone at +44 800 0885 134 or by email at info@landmarkmarkets.com. The platform also publishes links to its profiles on popular social media.

LandmarkMarkets Trading Terms

The intermediary claims to offer access to trading on over 1,000 financial instruments:

stocks;

indices;

commodities;

currencies;

ETFs.

The LandmarkMarkets brokerage does not disclose CFD specifications.

The firm offers Web Trader and MT5 for desktop and mobile devices as trading platforms. Demo account access for beginners has been announced.

Trading Accounts at Landmark Markets

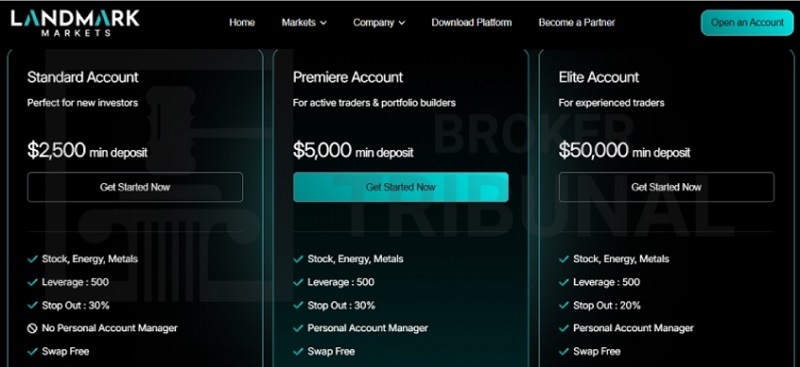

Clients of the Landmark Markets broker can choose from three trading accounts:

Standard with a deposit of $2,500 and a 30% stop-out. This plan is suitable for novice traders.

Premiere is for active traders with a deposit of $5,000 and a 30% stop-out.

Elite with an entry threshold of $50,000 is for experienced investors. Stop-out: 20%. A personal manager is available.

All accounts support swap-free trading and leverage up to 500x. The LandmarkMarkets broker promises ultra-tight spreads and zero commissions.

Registration and personal account on landmarkmarkets.com

To create a profile, the user must provide:

first and last name;

country of residence;

email and phone number;

date of birth;

password;

referral code.

To complete registration and log in to the landmarkmarkets.com personal account, the client must agree to the privacy policy and pass a captcha.

Deposits and withdrawals with LandmarkMarkets

The platform accepts deposits in USD, EUR, AED, CHF, and GBP. Although the company claims to support several payment methods, the website only mentions bank transfer and credit/debit cards. The speed of fund transfers is not specified.

Landmark Markets accepts the same payment methods for withdrawals. The terms are as follows:

withdrawals to a bank account take 3-5 days after application review;

withdrawals to a payment card occur within 10 banking days;

for all other methods, it takes 1 business day.

The LandmarkMarkets broker does not specify a minimum withdrawal amount, commissions, fees, or payment request processing time. You can inquire about these parameters by calling customer support at +44 800 0885 134. The necessary information may be available in your Landmark Markets personal account.

Conclusion about Landmark Markets

This financial intermediary positions itself as a regulated broker with official registration. However, the company does not provide proof of this, such as copies of licenses or a certificate of incorporation. Landmarkmarkets.com offers a superficial description of its trading terms and settlement rules. Its clients will not be able to assess potential investment risks and expenses in advance. For a better understanding of the actual terms of cooperation and the company's solvency, it is useful to read independent reviews of Landmark Markets.