Brief information Solidor Financiere

Multi-asset online broker Solidor Financiere claims to be an advanced platform for trading CFDs on popular assets. The broker says that it entered the market 8 years ago, but does not name the exact year.

It is stated that the headquarters of the broker Solidor Financiere is located at Cœur Défense 110 Espl. du Général de Gaulle, Paris, France. Also, the official website solidorfinanciere.com contains information about 8 offices in other countries, but without details. The intermediary introduces its team, but does not publish photos of employees and links to their profiles on social networks.

The Solidor Financiere broker claims to be a member of the Financial Commission, a non-governmental body that resolves disputes between intermediaries and investors. State financial regulators do not supervise the company. Also, the website solidorfinanciere.com does not contain a registration certificate. You can contact the financial agent via online chat, by phone +33170613843 and by email customer_support@solidorfinanciere.com. Support is available 24/6.

Solidor Financiere trading terms

According to the firm's terms, users can make deals with:

indices;

currency pairs;

metals;

energy resources;

digital assets.

The Solidor Financiere broker advertises trading hours, spreads and commissions in separate sections. It is reported that the company receives quotes from leading liquidity providers, but does not list them and does not confirm the fact of cooperation.

Trading accounts at Solidor Financiere

The intermediary distinguishes 3 types of accounts based on the cost structure and the method of order processing:

Standard STP — no commission per transaction, spreads from 1 pip;

RAW ECN — spreads from 0.1 pips, commissions from $0.03 for opening/closing 0.01 lots;

PRO ECN — commissions from $0.015 per trade, spreads from 0.1 pips.

The maximum leverage is x200.

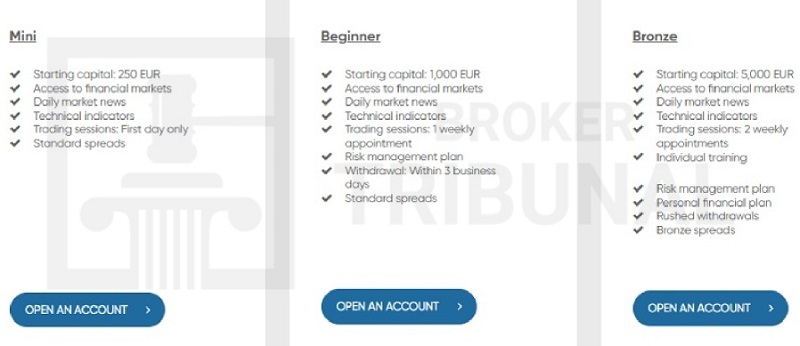

Depending on the minimum deposit, clients of the broker Solidor Financiere can choose the following accounts:

Mini with €250 entry threshold ;

Beginner — €1000;

Bronze — €5000;

Silver — €25,000;

Gold — €100,000;

VIP — €250,000.

The intermediary adds extra features through personalized service, which increases the account cost.

Trading platforms of the broker Solidor Financiere are represented by MetaQuotes WebTrader. You can work in the terminal from any browser. The company provides public access to the program, but to study the full functionality, you need to log in.

Registration and personal account on solidorfinanciere.com

To enter your personal account on Solidor Financiere, you must specify during registration:

first and last name;

email;

phone number;

country;

password.

It is also necessary to confirm that the user is an adult and does not have US citizenship.

Deposits and withdrawals with Solidor Financiere

For payment transactions, the intermediary offers to use:

payment cards;

bank transfers;

online payments via Skrill and Neteller

Boleto;

UnionPay.

The company claims that it does not charge a commission for replenishing an account. Withdrawal of money from Solidor Financiere takes up to 3 banking days. Limits and restrictions on withdrawal can be clarified with support by phone +33170613843.

Conclusion about Solidor Financiere

This broker operates without a license and does not have a registration certificate. Its trading conditions do not cover swap commissions and margin requirements, and the terminal is represented without a user manual and technical specifications. Reviews of Solidor Financiere will help you explore other opportunities and risks of cooperation.