Brief information Leverus

The global Forex and CFD broker Leverus positions itself as an authoritative market participant with many years of experience. The intermediary announces its launch in 2019. The footer of the official website leverus.online states that the brand belongs to Fius Capital Limited, and the company's head office is located at 150 South Bridge Rd, #06-04A Fook Hai Building, Singapore. However, the platform does not advertise the legal entity registration number and certificate of incorporation.

Also, the broker Leverus does not answer the following questions:

which financial regulators control its activities;

who is the founder of the company and is on staff;

how it receives liquidity and executes orders.

As of September 2025, the broker has registered 3 domains:

leverus.online;

user.leverus.digital;

wt.leverus.digital.

You can get answers to questions in the FAQ section. The broker also provides consultations via email and hotline phone number +97 1521 733131. Support is declared in 30 languages.

Leverus trading terms

The broker offers to make transactions with currency pairs and trade CFDs on:

stocks;

commodities and metals;

indices and ETFs;

cryptocurrencies.

Spreads are from 0.1 pips, commissions are not charged. Maximum/minimum transaction volumes, margin percentages and swaps of the Leverus broker can be studied in a dedicated table.

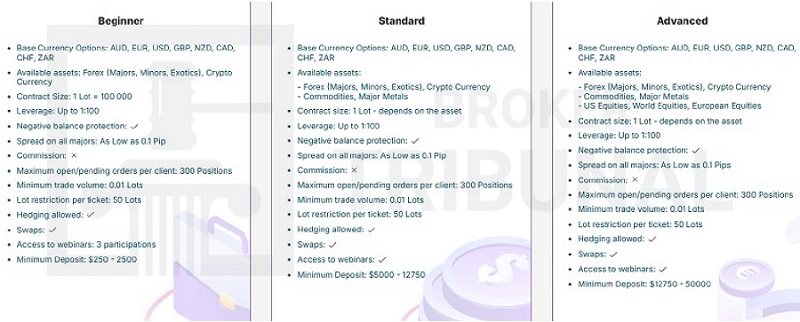

Trading accounts at Leverus

The company has developed 5 accounts with uniform conditions:

Beginner. Supported currencies are EUR, GBP, NZD, AUD, USD, etc. Leverage — up to x100. Negative balance protection and hedging are available. The lot size is 100,000. The maximum order size is 50 lots. The Leverus broker allows one client to have no more than 300 simultaneously open and pending orders. The initial account allows trading cryptocurrencies and Forex. The minimum deposit is $250.

Standard. The conditions of the initial account are supplemented with access to the metals and commodities markets. The entry threshold is from $5,000.

Advanced. The Leverus broker offers to make deals with shares with a deposit of $12,750.

Ultra. The minimum deposit is $50,000, assets include stock indices.

Premium. Traders are promised access to ETFs with a deposit of $250,000.

The Leverus broker provides a mobile and desktop TRADE terminal for work. However, its technical characteristics are described very superficially. There is no public access and user manual.

Registration and personal account on leverus.online

To create a profile and log in to your personal account on Leverus, you should fill in the form:

your first and last name;

contacts;

password.

The broker offers to pass verification by uploading copies of your ID to your profile.

Deposits and withdrawals with Leverus

The company claims to support the following payment methods:

credit and debit cards;

bank transactions;

local payment systems;

digital wallets.

Account replenishment is instant. Withdrawals from Leverus start at $250 and take from 24 hours. The broker reports no commissions or fees. More information about the payment policy can be found by calling support at +97 1521 733131.

Conclusion about Leverus

The company has no legal basis for its activities. Its statements about experience and authority are not supported by legal documents. Reviews about Leverus allow you to form an objective opinion about the broker.